Gregory Grant, Entreprenologist

Creative Capital – Building Social Assets

That Attract Financial Investment

In the world of entrepreneurship, capital is often misunderstood. It is seen as a destination, the holy grail that validates your business idea. Entrepreneurs chase it, pitch for it, sometimes beg for it and believing that if only they had the money, everything else would fall into place. This thinking is flawed. Capital is not a destination; it is a consequence. More importantly, it is a response to something deeper than a business plan or pitch deck.

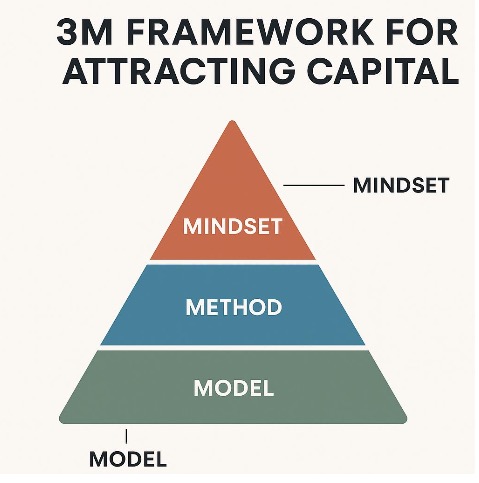

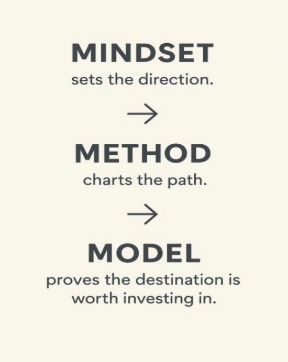

After years of working across government, education, and entrepreneurial ecosystems, I have discovered a transformative truth: capital does not chase need, it follows readiness. That readiness is not built overnight. It is the outcome of alignment between three foundational components: Mindset, Method, and Model. I call this the 3M Framework for Attracting Capital. This framework forms the philosophical backbone of my course Creative Capital: Building Social Assets That Attract Financial Investment. In this article, I will unpack the 3Ms in detail, what they mean, why they matter, and how aligning them prepares entrepreneurs to earn capital, not chase it.

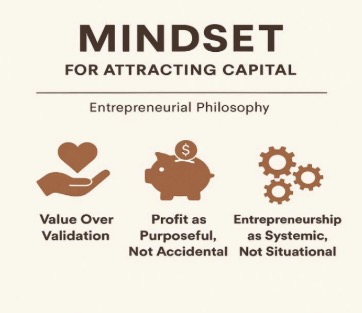

MINDSET: Shifting from Hustle to Strategic Ownership

Most entrepreneurs begin with a hustle. They grind, improvise, and “figure it out.” Hustle is commendable, but it is not scalable. Eventually, the same energy that builds a business in the beginning becomes the very thing that burns it out. To attract capital, one must transcend hustle and develop a strategic ownership mindset. This means internalizing three key mental shifts:

A. Value Over Validation

Entrepreneurs often seek validation through social media likes, clicks, recognition, or investment. But validation is fleeting. Value is sustainable. A mindset focused on creating real, usable, and relevant value for others will outlast any short-term applause. When you create value, capital finds you.

B. Profit as Purposeful, Not Accidental

Too many entrepreneurs treat profit as a leftover. They hope there is something left after all expenses are paid. This mindset is reactive and dangerous. A strategic owner preserves profit on purpose. This is where the Profit First Methodology becomes transformational. It flips the accounting equation to prioritize profit before expenses. When profit is intentional it becomes powerful, not just financially, but psychologically.

C. Entrepreneurship as Systemic, Not Situational

Mindset is not about reacting to problems. It is about building systems that prevent problems in the first place. A strategic entrepreneur develops internal beliefs and routines that are consistent, not circumstantial. This includes how you manage time, how you treat money, how you build relationships, and how you make decisions under pressure. In short, the capital you attract reflects the mindset you protect. Investors and funders do not fund ideas, they fund the people who are thinking clearly, acting strategically, and operating from a place of purpose and precision.

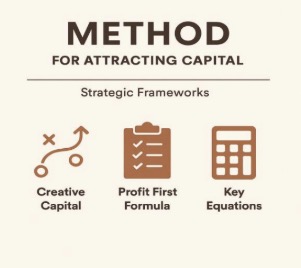

METHOD: Codifying the Financial Behavior of Entrepreneurs

Once the mindset is in place, the next layer is method. Method is not about what you believe, it is about what you do consistently. Method answers the question: What is your system for managing money, making decisions, and creating outcomes?

Too often, entrepreneurs confuse activity with strategy. They are busy but not productive. They make money but cannot explain where it went. They pitch ideas but do not track margins. This lack of method is why many businesses plateau or collapse.

Let us explore three essential methods that transform financial behavior into financial readiness:

A. Profit First Implementation

Developed by Mike Michalowicz, the Profit First method has changed how entrepreneurs think about cash flow. Instead of following the traditional model of Revenue – Expenses = Profit, entrepreneurs using this methodology adopt Revenue – Profit = Expenses.

This simple switch prioritizes profit and forces operational discipline. Entrepreneurs set up separate accounts for profit, taxes, and operating expenses. Each deposit is allocated with purpose. The result is that businesses learn to operate within their means and build a reserve for growth.

This method also sends a strong signal to investors: “I know how to manage money.” If you cannot handle $10,000, you will mishandle $100,000.

B. Expense Discipline and Strategic Forecasting

Capital readiness is not just about how much money you have; it is about how precisely you plan to use it. Entrepreneurs must adopt forecasting as a behavior, not just a quarterly report. Forecasting helps you align spending with priorities and identify what needs to be cut or restructured.

Entrepreneurs must answer:

- What are your fixed vs. variable costs?

- What does your burn rate look like?

- How many months of runway do you have?

- Can you model your break-even point and margin targets?

These are not corporate buzzwords. They are the language of capital readiness.

C. Leverage Without Desperation

Too often, entrepreneurs seek capital in panic when they are out of cash, out of time, or out of options. This is the worst time to negotiate. The method of creative capital flips that. We teach entrepreneurs to treat profit margins as assets, and to use them as leverage points in capital conversations.

When you walk into a room and can show traction, margin discipline, operational control, and community loyalty, you do not have to beg for capital. You are a partner, not a problem.

Method is the bridge between intention and execution. Without it, mindset remains theory. With it, capital becomes a natural next step.

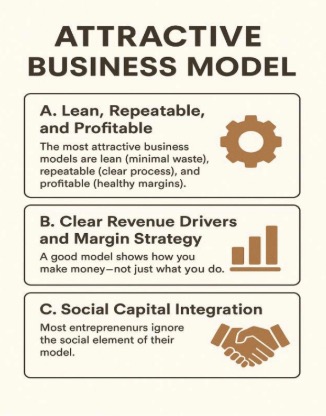

MODEL: Designing a Business That Signals Readiness

The final “M” is Model which is your actual business structure, delivery system, and value chain. Even if you have the right mindset and the right methods, if your business model is flawed or unscalable, capital will not follow.

The business model is where form meets function. It answers the investor’s question: Is this idea structurally sound and scalable?

Here are three essential components of a capital-attractive model:

A. Lean, Repeatable, and Profitable

The most attractive business models are lean (minimal waste), repeatable (clear process), and profitable (healthy margins). Investors want to know: Can this be done again and again without reinventing the wheel every time?

This is where tools like the Business Model Canvas become useful, not just as planning tools, but as storytelling devices. They help you communicate how value is created, delivered, and captured in a way that is simple, compelling, and scalable.

B. Clear Revenue Drivers and Margin Strategy

A good model shows how you make money, not just what you do. Are your revenue streams diversified? Are you relying too heavily on one customer? Do you understand your margins by product or service?

Entrepreneurs often over-focus on the idea or the brand. But investors care about mechanics. They want to see a model that runs smoothly and generates cash consistently.

C. Social Capital Integration

This is where the idea of Creative Capital becomes central. Most entrepreneurs ignore the social element of their model.

But community, trust, and reputation are powerful variables.

How is your brand perceived?

Do you have loyal customers?

Are partners willing to vouch for your value?

Do you have a referral system or stakeholder network?

A model that integrates social capital with operational efficiency sends a powerful message: “We are not only functional, but we are also rooted.” And that rooting through trust, community, and mission is the most undervalued asset in today’s financial landscape.

The Creative Capital Advantage

The 3M Framework of Mindset, Method, and Model is not just theory. It is a capital attraction system. When these three align, the business becomes a magnet for money, not just because it is promising, but because it is proven.

This is the basis of my course, Creative Capital: Building Social Assets That Attract Financial Investment. In it, we explore how to build not only a business, but a capital-ready ecosystem that investors want to support. We teach how to think like a strategist, operate like a professional, and grow like a visionary.

This is not fundraising for the desperate. This is capital stewardship for the determined.

Whether you are launching a side hustle or scaling a six-figure venture, your ability to align mindset, method, and model will determine whether capital is a struggle or a source of strength.

In the course, you will learn to:

- Think like an owner, not an operator.

- Treat profit like an asset, not an afterthought.

- Build community trust that converts into opportunity.

- Choose the right type of capital for the right stage.

- Communicate your value with clarity, not complexity.

If you are ready to stop chasing capital and start attracting it this course was built for you.

Final Word

Capital is not about what you ask for, it is about what you have built. The 3M Framework empowers entrepreneurs to stop pitching for help and start preparing for partnership.

The more aligned you are internally, the more capital will align with you externally.

Let us stop chasing capital and start building with precision to attract capital.

Book Recommendations: (Grant, 2025)