Bridging Business Strategy and Entrepreneurial Capital-Readiness

Author: Gregory Grant, Entreprenologist

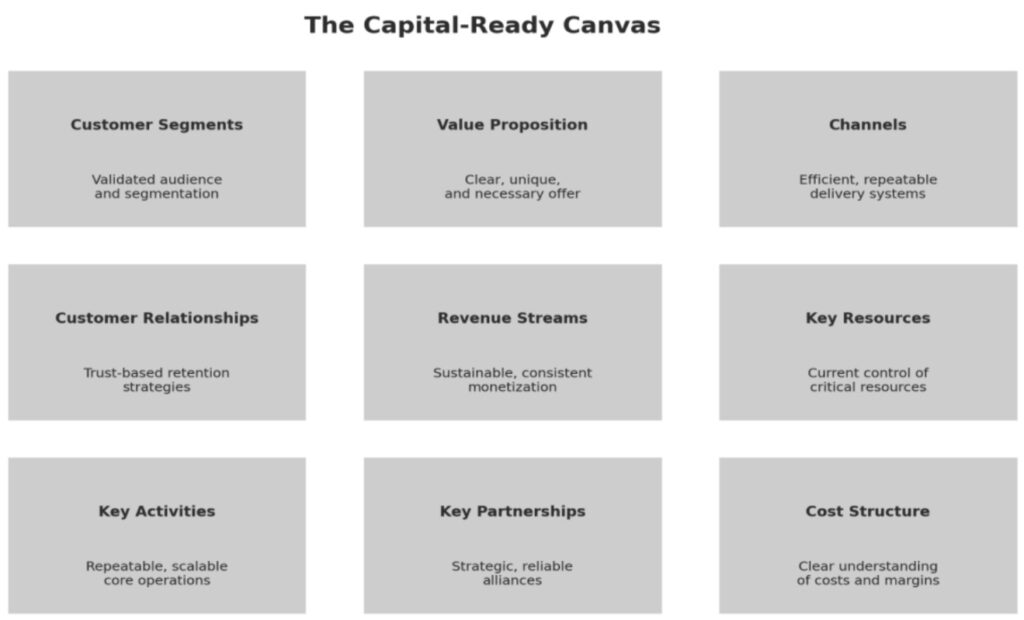

Introducing the Capital-Ready Canvas, a strategic adaptation of Alexander Osterwalder’s

Business Model Canvas, tailored for entrepreneurs seeking not just capital access but capital

readiness. By merging entrepreneurial philosophy with practical business model design,

this framework transforms the traditional nine building blocks into a capital-readiness

roadmap. Each segment of the canvas becomes a diagnostic point inviting entrepreneurs to

reflect on their clarity, capacity, and credibility before engaging capital. This manuscript

offers a new lens on how structure, philosophy, and strategic alignment form the foundation

of responsible capital engagement.

Introduction: From Access to Readiness

The entrepreneurship world has long been obsessed with one word: access. Access to

funding. Access to networks. Access to opportunity. While these are important, they are

insufficient. Access without readiness is like handing car keys to someone who has never

learned to drive. It is not a gift, it is a gamble.

This articulation proposes a shift: from access to readiness. Readiness is the internal

condition that allows an entrepreneur to receive, manage, and multiply capital responsibly.

It is the result of clarity, control, and credibility across all facets of a business.

To operationalize this philosophy, we adapt the well-known Business Model Canvas by

Alexander Osterwalder into a new framework called The Capital-Ready Canvas. Instead of

using the BMC purely as a design tool, we reimagine it as a diagnostic instrument, one that

measures an entrepreneur’s true preparedness for capital.

Rethinking the Business Model Canvas for Readiness

The Business Model Canvas (BMC) is a strategic tool designed to help entrepreneurs

visualize, test, and iterate their business models. Its nine segments provide a

comprehensive snapshot of how a business creates, delivers, and captures value.

But the BMC is more than a planning tool, it is a window into readiness. When each block is

viewed through the lens of capital engagement, it becomes a test of structure, discipline, and

strategic intent. The Capital-Ready Canvas builds on this concept by asking not just whether

a business model exists, but whether it is ready for outside capital.

The Nine Building Blocks as Readiness Indicators

Customer Segments

Readiness Question: Have you validated your audience?

Investors and lenders want specificity. Who exactly are you serving? Can you prove they

exist and are willing to pay? A capital-ready entrepreneur knows their primary and

secondary markets and can back it with evidence.

Value Proposition

Readiness Question: Is your offer both unique and necessary?

If your value proposition is unclear or undifferentiated, capital will accelerate confusion.

The market must not only want it, it must need it. Clarity and necessity are indicators of a

well-formed vision.

Channels

Readiness Question: How will your value reach your customers efficiently and repeatedly?

You must demonstrate delivery strength. If your channels are costly, inconsistent, or

unproven, readiness is compromised. Capital looks for systems that scale.

Customer Relationships

Readiness Question: Do you have a retention strategy, not just acquisition?

One-time buyers are not sustainable. Readiness includes a plan to create loyalty, feedback

loops, and long-term engagement.

Revenue Streams

Readiness Question: How do you make money and how consistent is it?

Capital readiness requires a monetization model that is logical, profitable, and ideally,

recurring. Unpredictable income is a red flag.

Key Resources

Readiness Question: What assets do you already control, people, systems, brand?

Readiness is not about what you will buy after funding. It is about what you already

steward. The presence of resources indicates capacity.

Key Activities

Readiness Question: What are the core activities that drive your model?

You must know what you do daily to create value. If your operations are unclear, capital will

expose your inefficiency.

Key Partnerships

Readiness Question: Who are your allies, vendors, and collaborators, and are they reliable?

Partnerships can extend capacity or create liability. Readiness means aligning with those

who strengthen your business, not drain it.

Cost Structure

Readiness Question: Do you understand your burn rate, margins, and cost drivers?

You must show that you understand your financial model. Clarity in cost structure helps

predict your capital needs and use.

Readiness Scores: A Diagnostic Layer

To make The Capital-Ready Canvas actionable, entrepreneurs can score each of the nine

segments on a scale from 1 (low readiness) to 5 (high readiness). This transforms the

canvas from a visual framework into a performance dashboard.

For example, if a business scores a 5 in Value Proposition but a 2 in Revenue Streams, it

reveals a gap between what they offer and how they monetize. This clarity enables strategic

focus. It also prepares the entrepreneur to answer difficult questions from funders with

confidence and honesty.

Rate your readiness for each component of your business model on a scale of 1 to 5:

1 = Not Ready • 2 = Somewhat Ready • 3 = Moderately Ready • 4 = Mostly Ready • 5 =

Fully Ready

Philosophy Behind the Canvas: Readiness Is Identity

Entrepreneurial Capital Readiness is not a checklist—it is a character. It is a reflection of

how deeply an entrepreneur understands their business, their value, and their

responsibility.

This canvas does not just measure readiness. It builds it. It forces entrepreneurs to confront

the hard questions before they are asked by others. It repositions entrepreneurship as a

practice of alignment—where internal structure matches external opportunity.

Ultimately, The Capital-Ready Canvas helps the entrepreneur answer a deeper question: Am

I someone capital can trust?

Use this checklist to assess your readiness across each of the nine blocks of your

business model.

Customer Segments

☐ Have I clearly identified and segmented my target customers?

☐ Do I have data to support the existence and demand of these segments?

Value Proposition

☐ Can I clearly articulate what makes my product/service unique?

☐ Is there proven market need for my offering?

Channels

☐ Do I have established, cost-effective methods to reach my customers?

☐ Can I consistently deliver my product/service?

Customer Relationships

☐ Do I have a defined strategy for building and maintaining customer relationships?

☐ Are there systems in place to encourage repeat business?

Revenue Streams

☐ Do I know how I make money and is it profitable?

☐ Are my revenue streams stable and recurring where possible?

Key Resources

☐ Do I currently control the essential resources (people, IP, systems)?

☐ Are my existing resources aligned with my business goals?

Key Activities

☐ Do I know the core operations that drive value in my business?

☐ Are these activities documented and repeatable?

Key Partnerships

☐ Have I identified and engaged reliable strategic partners?

☐ Do these partnerships add value and reduce risk?

Cost Structure

☐ Do I understand my fixed and variable costs?

☐ Can I accurately forecast and manage my expenses?

Capital Does Not Build Models, But Will Test It.

Capital is not a reward. It is a test. It does not build structure, it reveals it. Entrepreneurs

who pursue capital before building readiness often experience burnout, mission drift, or

public failure.

The Capital-Ready Canvas reframes funding as a function of preparedness, not persuasion.

It turns business modeling into a readiness ritual. Entrepreneurs who use this tool are not

just chasing checks, they are building vessels strong enough to carry vision. They are taking

responsibility for the full architecture of their business: the clarity of their value, the logic of

their delivery, the strength of their operations, the credibility of their relationships, and the

sustainability of their finances.

Capital-Readiness is not a destination. It is a habit. It is a way of thinking, building, and

refining. It is a posture of financial stewardship, choosing to be trustworthy with funding

opportunities, before the opportunity arrives. In this sense, readiness becomes identity.

Not just what you do, but who you are.

So here is your invitation:

• Do not wait for capital to force structure. Build it now.

• Do not wait for the pitch to define your model. Refine it now.

• Do not wait for performance pressure to reveal the cracks. Reinforce your

foundation today.

Use the Capital-Ready Canvas to interrogate your model deeply. Score your readiness

honestly. Identify what is strong and what needs attention. Develop a narrative that reflects preparation, not persuasion. Let this tool serve not just as a framework, but as a capital-ready mirror.

Because the truth is simple:

Capital will come when you are ready, not when you ask for it.

Build readiness, and capital will not be a chase. It will be a choice.

Book Recommendation

Osterwalder, A., & Pigneur, Y. (2010). Business model generation: A handbook for visionaries,

game changers, and challengers. Wiley.